Is Russia an Attractive Private Equity Market?

Much has been made of the massive $51 billion Russia has spent on the Sochi Olympics, spurring allegations of corruption and indulgence by contractors, government employees and leaders alike. But this isn’t Russia’s first extravagant project. The country spent more than $20 billion to makeover its Far Eastern port of Vladivostok for the 2012 APEC Summit and expects to spend just as much for the 2018 World Cup. It seems Russia is betting on itself as it seeks to take a bigger place on the international stage. But are private equity and venture capital firms doing the same?

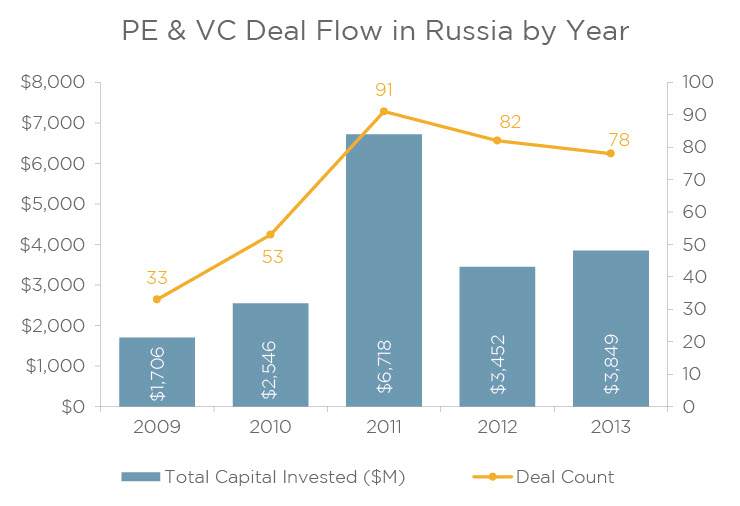

Source: PitchBook

PitchBook data show that PE and VC investment in Russia took off in 2011 and stagnated in 2012 and 2013. Nearly $7 billion was invested across 91 deals for Russian companies in 2011, up from 53 deals and $2.6 billion in 2010. Last year, PE and VC firms poured $3.9 billion into 78 deals. This level of deal-making likely reflects the confidence local and outside investors had in the Russian economy at the time. For instance, in 2010 and 2011, GDP growth was 4.5% and 4.3%, respectively, a major jump from the negative 7.8% rate the country saw in 2009. But the GDP growth rate declined to 3.4% in 2012, and Russia expects its economy to stagnate over the next two years after posting a 1.4% growth rate in 2013, with the economy ministry forecasting declining growth in consumer demand and flat corporate investment. Interestingly enough, PE and VC investment has already fallen off slightly since a high in 2011.

Palace Square in Saint Petersburg | Photo by Allen Wagner

Besides recent economic trends, more fundamental issues may be an issue for Russia to attract private capital from abroad. In an article in the Moscow Times earlier last year, Leonid Saveliev, a partner at EY in Moscow, wrote that Russia is becoming a more attractive country to foreign investors even though Western firms may still be wary of conducting business in such an undeveloped, suspect market. He notes that well-known firms—such as TPG Capital and Intel Capital—have local investment teams; recent government initiatives have been created to attract PE firms (the Russian Direct Investment Fund co-invests on deals, for instance); Russia has a large domestic workforce that “does quality work for a reasonable cost;” and the country sits at the crossroads between East Asia and Europe, giving it an edge over China in the fight for investment capital.

On the face of it, some of these appear true, but they mask underlying problems with the Russian economy that deter investment. For example, regarding Russia’s workforce, the country’s population is currently at 143 million, but life expectancy is low (69 years as of 2011, compared to 73 in China and over 80 in some European countries) and population growth is beneath the replacement rate needed to substantially grow, let alone maintain, current levels.

Finally, while outside firms may have set up shop in Moscow to take advantage of the local market, the actual number of active foreign investors in Russia is quite low. After TPG Capital, the largest single investor (by AUM) with an office in Russia is its own Russian Direct Investment Fund, according to PitchBook. And only 10 outside PE and VC firms that have an office in Russia have actually made an investment in the country.

Still, there is promise, at least on the tech side, according to Sergey Toporov, senior investment manager at LETA Capital, a Moscow-based early stage VC firm.

“The venture capital market is young in Russia, so there are a lot of opportunities and little competition between funds. Russia also has a lot of talented engineers and inventors who create amazing technology. And of course, we have a rapidly growing IT market, as internet penetration expands throughout the country.”

While mega-projects along the lines of Sochi, Vladivostok and the World Cup may not ultimately attract investment to Russia, the goals make sense. As in any country, projecting a stable economic environment, building infrastructure improvements and showcasing the best the country has to offer all play a part in enticing foreign investment.

“I think we need time,” said Toporov. “Time to establish our laws. Time to establish better infrastructure in terms of payments and logistics. And of course, time to create more success stories among Russian technology companies to make outside investors believe in our market.”