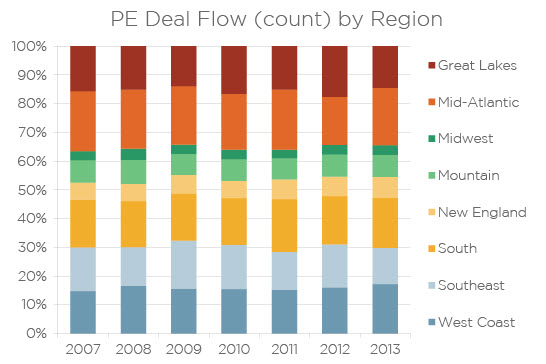

2013 in Review: Most Active U.S. Regions for PE Investment

The Mid-Atlantic, South and West Coast were the three most active regions for private equity investing in 2013, according to PitchBook data, as of Dec. 16. The Mid-Atlantic and South received a disproportionate amount of capital from PE firms this year,

Here’s what went down region by region in the U.S. this year:

Mid-Atlantic

Typically the most active region for private equity deal-making, the Mid-Atlantic region has continued to lead the United States in attracting PE investors this year. The region—which includes Delaware, Maryland, New Jersey, New York, Pennsylvania, Virginia, Washington, DC, and West Virginia—saw 402 deals through Dec. 16 and comprised just shy of 20% of all PE deal flow in the United States in 2013, PitchBook data show.

Typically the most active region for private equity deal-making, the Mid-Atlantic region has continued to lead the United States in attracting PE investors this year. The region—which includes Delaware, Maryland, New Jersey, New York, Pennsylvania, Virginia, Washington, DC, and West Virginia—saw 402 deals through Dec. 16 and comprised just shy of 20% of all PE deal flow in the United States in 2013, PitchBook data show.

The $23.2 billion buyout of condiment-maker Heinz—which is headquartered in Pennsylvania—and 17 other $1 billion-plus PE deals helped the Mid-Atlantic comprise a leading 26.5% of capital invested in U.S. companies in 2013. This is a sharp increase from the 15.6% it comprised last year.

While Pennsylvania contributed heavily to the capital invested in the region, the Keystone State contributed just 19.2% of the Mid-Atlantic’s deal flow in 2013, down from 25.2% last year. New York made up for much of that decline, increasing its share of PE deal flow in the region from 28.7% in 2012 to 34.1% this year.

South

Always an attractive region for private equity investment, the South made up 17.4% of deal flow in 2013, with 352 investments through Dec. 16. Remarkably, since 2006, the South has never comprised less than 16.1% or more than 18.4% of deal flow. But 2013 saw a spike in capital invested in the region, thanks to the $24.9 billion buyout of Dell. The South attracted 25% of capital this year, up from 19.4% last year.

Always an attractive region for private equity investment, the South made up 17.4% of deal flow in 2013, with 352 investments through Dec. 16. Remarkably, since 2006, the South has never comprised less than 16.1% or more than 18.4% of deal flow. But 2013 saw a spike in capital invested in the region, thanks to the $24.9 billion buyout of Dell. The South attracted 25% of capital this year, up from 19.4% last year.

Other large deals in the South include the $6.9 billion buyout of BMC Software and the $6 billion buyout of Neiman Marcus. Both companies are based in Texas.

Texas comprised 69.3% of all PE investments in the South with 244 deals. Tennessee and Oklahoma had 43 and 32 investments, respectively, to make up a combined 21.3% of the region’s PE deals.

West Coast

The West Coast comprised 17.2% of all private equity deal flow in the United States in 2013, but made up just 13.3% of capital invested. This was largely thanks to mega-buyouts in other regions, and the fact that there were only four buyouts of more than $1 billion in the entire West Coast this year, all in California.

The West Coast comprised 17.2% of all private equity deal flow in the United States in 2013, but made up just 13.3% of capital invested. This was largely thanks to mega-buyouts in other regions, and the fact that there were only four buyouts of more than $1 billion in the entire West Coast this year, all in California.

The 348 PE investments in West Coast companies this year, through Dec. 16, is on pace to be lower than the 393 from last year. But the region has increased its share of deal flow by 1% each year since 2011, when the West Coast comprised 15% of deal flow. Whether this trend continues into 2014 and beyond will remain to be seen, but the West Coast has fared better economically than most regions since the financial crisis.

California, which has led among all states in deal count six of the last seven years, saw 272 PE investments through Dec. 16. Meanwhile Washington had 48, Oregon had 23 and Hawaii and Alaska combined for five.

The Rest

The Mid-Atlantic, South and West Coast were the most active regions for PE investing in 2013. | Source: PitchBook, data through Dec. 16, 2013

The Great Lakes saw 14.6% of PE deal flow in 2013, which is down from 18% a year ago, but not much different from historical norms around 15% to 16%. Similarly, the Mountain region has remained fairly steady in its proportion of deal flow, fluctuating mildly between 7.3% and 7.7% over the last five years. In both 2012 and 2013, the Mountain region—which includes Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Utah and Wyoming—comprised 7.7% of deal flow, while in 2011 the region saw 7.4%.

While deal flow has been steady across most regions, New England has actually seen its share of overall private equity investment grow from 6.0% in 2010 to 7.3% this year.

This article originally appeared on the PitchBook Blog