2013 in Review: 4 Private Equity Takeaways from Europe

Eurozone countries have already faced the worst of their sovereign debt crisis and high unemployment. And while most European economies haven’t fully turned things around, it appears that there has been some GDP growth and either stabilization or reduction in unemployment across most countries on the continent. Europe still has a long way to go to reach pre-financial-crisis levels of economic growth and private equity investing, but PitchBook data show some positive trends for the continent heading into 2014. Here are the four most interesting takeaways from our data:

Deal flow in Europe on the upswing

One of the immediate takeaways from PitchBook’s European data is that private equity investment on the continent appears to have rebounded, with PE deal-making at its highest level since 2008. More than $110 billion in capital has been invested in European companies through Dec. 15, though some in the European PE community believe the continent can still attract more investment.

George Anson, managing director at HarbourVest Partners U.K., noted in a recent piece for the European Private Equity and Venture Capital Association, that since the financial crisis, “Europe is short of long-term investment capital, which it needs to build more great companies. The European economy is not suddenly going to get better overnight but private equity investors are in it for the long-term and when things do get better—as they will—their businesses will be in pole position to benefit.”

PE firms, which generally have long-term horizons on their investments, would appear to be prime candidates to fill the void where European companies need capital. Whether PE deal-making continues on its upward trend in 2014 remains to be seen, but as the European Central Bank has steadied sovereign debt markets and major risk has been fairly reduced, the environment looks more stable for firms to invest.

U.K. and France trending in opposite directions

With stability in mind, many investors flocked to the U.K. in 2012 and 2013 to make deals. The U.K./Ireland region attracted nearly 40% of private equity investments in 2013 (through Dec. 15). This is up from about 32% in 2012 and 29% in 2011. While most of the other major European regions—such as Southern Europe, the Nordic countries, GSA and Central & Eastern Europe—retained a similar share of PE deal flow over the last couple of years, France & Benelux has seen its share drop. After peaking at 33% of deal flow in 2011, France & Benelux has comprised just 23% so far in 2013.

The U.K. & Ireland region has increased its share of European PE deal-making in the last two years. | Source: PitchBook (data as of Dec. 15, 2013)

There are probably numerous explanations for how and why this shift has occurred. But one of the main culprits may have been French President Francois Hollande’s proposal to increase tax rates on high-income earners (which would have included carry on PE investments) to 75%. This issue caused the private equity industry to frown on France just as conditions in Ireland started improving and the U.K. (which doesn’t use the euro) saw GDP growth in 2013.

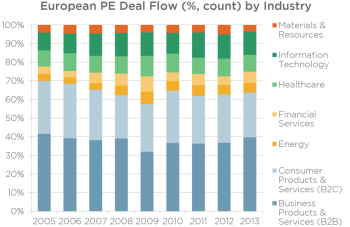

B2C Down, B2B Up

B2C has shrunk as a percentage of deal flow in Europe in 2013, while B2B has grown. | Source: PitchBook (data as of Dec. 15, 2013)

Another interesting trend that is most likely reflective of the current economic climate in Europe is a shift in PE investing away from B2C companies. With generally high unemployment across Western and Southern Europe, disposable income for consumer products and services is in short supply, contributing to a lack of solid opportunities for PE firms seeking potential growth or value-adding opportunities on the continent. B2C comprised 24% of all private equity investments in Europe this year, but made up 28% in 2010. Meanwhile, B2B grew its share of investments from 37% in 2010 to 40% in 2013.

Industry breakdown varies by region

Interesting investment trends emerge when looking at PitchBook data on each region within Europe. For example, B2B comprised roughly 45% of PE deal-making in France & Benelux in 2013, but only about 31% in the Germany, Switzerland and Austria region. There were, instead, a higher proportion of information technology deals in GSA. See the charts below for each region’s deals by industry.

Source: PitchBook (data as of Dec. 15, 2013)

Originally appeared in the PitchBook Blog