The “Employment Situation,” and the Impending Collapse of the American Economy

While the economy is inching along in its recovery, once a month the “Employment Situation” spells its impending doom. The talking heads and economic pundits will have you believe that each successive report is the worst yet, and the economy will certainly collapse as a result. However, this sentiment is not in the least bit shared by startup founders.

On Friday, the Bureau of Labor Statistics released the “Employment Situation” report for Aug. 2013. As with any of these reports over the past 4+ years, the commentary has been overwhelmingly negative. It is hard to argue that this was a good report, yet it is hardly apocalyptic. Perhaps the best description is lackluster. Total nonfarm payroll increased by 169,000 with retail and health care being the driving industries, hardly a dent in the unemployment rate; the unemployment rates of major demographic groups were, essentially, unchanged; the information sector lost 22,000 jobs. However, the overall sentiment within the startup community stands in very stark contrast to this jobs report with an all-time-high confidence level.

The “Startup Confidence Index” (based on a quarterly survey of newly incorporated businesses conducted by the Kauffman Foundation and LegalZoom – PDF report for detailed methodology) however, found that startup business owners’ confidence is at an all-time high. Of the survey questions asked, several stand out:

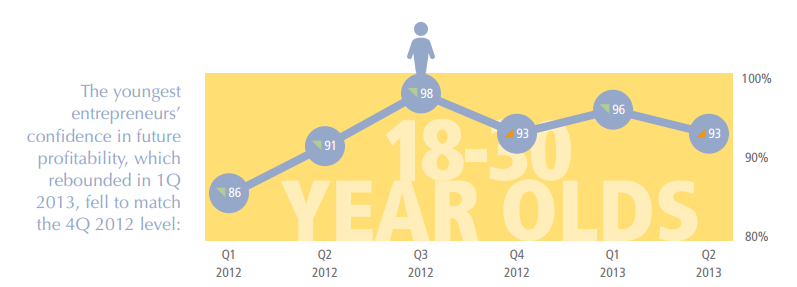

How confident are you that your business will be more profitable in the next 12 months than it is today?

The answers to this question were, perhaps, the most remarkable. Of those 1,700+ that were polled, only a mere 15% were not confident that they would be more profitable in 12 months time. A whopping 85% polled were at least somewhat confident that they would see increased profits in 12 months, with 93% and 91% of those in the 18-30 and 31-40 year old age brackets, respectively. If, as a country, we are supposed to take the jobs report as sacrosanct and base our whole outlook on it – as some pundits will have you believe – no one bothered to tell startup founders.

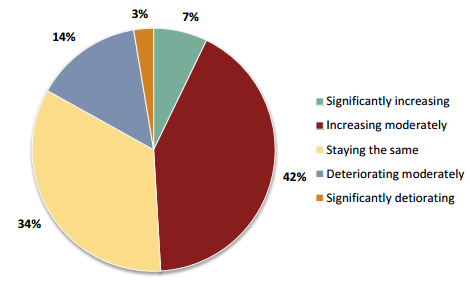

What do you see happening to consumer demand over the next 12 months?

With an increase of 5% over the 1Q, 2013 report, 49% of those polled in the 2Q report believe consumer to increase moderately to significantly in the next year. Perhaps more important, of those polled only 17% believe there will be a net decrease in consumer demand.

WHAT DO YOU THINK WILL HAPPEN WITH THE ECONOMY OVER THE NEXT 12 MONTHS?

A whopping 74% of those polled believe that the economy will either stay the same or improve over the next year, representing a net positive increase of 10% from the 1Q, 2013 poll. This is the most important question within the report. The root of the 10% increase are more important than any jobs report.

So what changed in one quarter?

Well, there were four different “Employment Situation” reports that all reported nearly the exact same thing as the Aug. 2013 report, and the impending doom of the economy if we are to believe the pundits; more than 700,000 jobs have been added to the economy; in the last three months, 3,666 startups have been added to AngelList; using a new methodology, Brookings published a study arguing that previous estimates and figures related to STEM jobs (science, technology, engineering, and math) have completely missed the mark and, “As of 2011, 26 million U.S. jobs—20 percent of all jobs—require a high level of knowledge in any one STEM field.”

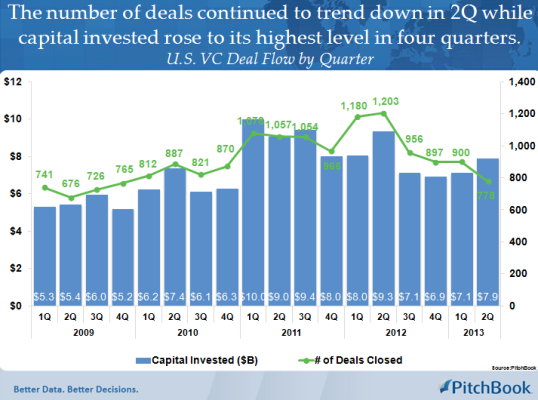

What about investments and deals?

Although both the number of deals/investments closed and the $ value of said deals are still below 1Q 2011-2Q 2012 numbers, there is a distinct upward trend. Of the companies formed during Q1 and Q2 of 2013, Crunchbase lists 261 rounds raised (of a total of 1000 rounds in 2013 thus far). Further, PitchBook notes this upward investment trend in their “3Q 2013 Venture Capital Rundown Report,” (see slide below).

It is easy to get bogged down in all the negative punditry surrounding the jobs report, but the talking heads only cover the numbers. The Kauffman/LegalZoom “Startup Confidence Index,” however, paints an entirely different picture. Not only are startup founders unaffected by the job report’s, they are as confident in the economy as they have ever been. VC firms and angel investors appear to be equally unaffected as deals and investments are on the rise. This is not to argue that the job report’s are not useful; they certainly are. However, it is hard to take them as the be-all-end-all barometer of macroeconomic health, especially when there is so much evidence to the contrary.

This is only my opinion. Feel free to disagree and call me names in the comments.