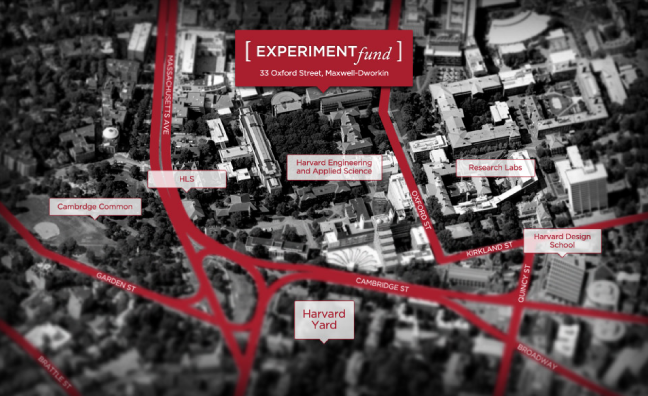

Harvard University has begun a new program designed to take on the accelerators that lure so many would-be students away from the college. The Experiment Fund (Xfund) launched on Jan. 27, 2012, is a seed-stage investment fund aimed at funding Harvard student, and alumni, startups. The Xfund is a roughly $10 million pool of funds from the Harvard Student Agencies (HSA), and three wildly successful venture capital firms: New Enterprise Associates (NEA), Polaris Partners, and Accel Partners. Whats more, one of the main partners of the fund, Hugo Van Vuuren, doubles as the Universities’ venture capitalist in residence.

While schools such as MIT– which offers funding for student-run startups – and Stanford – which runs its own in-house startup accelerator StartX – have been supporting student entrepreneurship for some time, the Xfund is the first collaboration between a University and venture capital funds. Though a collaboration between venture capital and a university seems antithetical on the face, the university and the Xfund have set up clear safeguards. According to Michael B. Farrell, in his Harvard makes space for venture capitalist:

By aligning with the Experiment Fund, Harvard is able to steer students to venture capitalists with ties to the school, with the expectation that the investors will not encourage them to drop out. In exchange for access to the campus and Harvard students, Van Vuuren and his colleagues will provide mentoring and advice to the students while they are undergrads, but no money until after they have graduated or leave school.

So what has the Xfund invested in thus far?

The Xfund lists four companies in its portfolio:

Rock Health

Rock Health

Rock Health is seed-stage accelerator for digital health startups. Applications open in October 2013

Tivli

Tivli

Tivli is an IP-based television service that delivers live streaming access of major broadcast as well as cable channels to university students. The company just raised a $6.3 million A round lead by NEA, with an investment from Mark Cuban’s Radical Investments as well.

Zumper

Zumper

Zumper is a more efficient and streamlined apartment rental marketplace. They launched at, and were finalists at TechCrunch Disrupt SF 2012.

Omada Health

Omada Health

Omada Health actually went through the Rock Health Accelerator. So far, Omada has launched one program, “Prevent,” a 16-week clinically-proven program to help curb the risk factors for type 2 diabetes for those at risk. They also just raised a big $4.7 million series A round.

The Experiment Fund is already breaking down some of the traditional barriers between venture capital and the university system. In a little more than a year and a half of operation, the startups in Xfund’s portfolio have raised a total of more than $10 million. It is hard to imagine that this trend from a University in Boston, well outside of Boston, does anything but continue to build momentum.