King Digital Entertainment, the company behind such games as Candy Crush Saga and Farm Heroes Saga, wen public on 26 March 2014. The company announced the proposed scope of their initial public offering (IPO) on Monday 25 March 2014:

King Digital Entertainment plc (NYSE: KING), a leading interactive entertainment company for the mobile world, today announced the pricing of its initial public offering of 22,200,000 of its ordinary shares at a price to the public of $22.50 per share. King is offering 15,533,334 shares and certain selling shareholders are offering 6,666,666 shares.1

However, the market had other ideas. The lackluster opening was, perhaps, best described in an article from The Verge yesterday:

King Digital Entertainment…went public this morning on the New York Stock Exchange after raising about $500 million in an IPO that valued the company at about $7.6 billion. But it fell short of that valuation with a poor early response from the market, with shares opening at $20.50 — beneath the offer price of $22.50 — and falling still lower.2

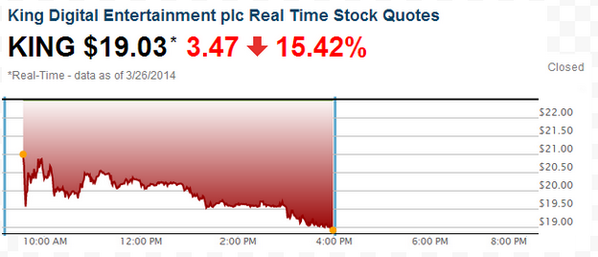

It did not get much better for King as the day went on. The $KING stock finished the day at $19.03, down more than 15%:

Via @PrivCo

The $KING IPO turned out to be the worst initial public offering of 2014.3 The disappointing opening was incredibly similar to Zynga’s IPO of late 2011, though $KING had a more dramatic downturn at the day’s close. Here is what CNNMoney had to say about the Zynga IPO:

Zynga had priced its IPO at $10 a share late Thursday [15 December 2011 – one day prior to their IPO]. Under the ticker ZNGA, Zynga began trading Friday at about 11 a.m. ET on the Nasdaq stock exchange. It soared as high as $11.50 before falling back, dropping to $9.52 in its first 15 minutes of trading. The stock spent most of the day below $10 and closed at $9.50, down 5% from its offering price.4

That is not where the similarities end. We wrote about Kings IPO Prospectus back in February. In said prospectus, it was noted that King, “generated $1.9 billion in revenues in 2013, or $5 million a day. It posted adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) of $825 million in the year, up from $28.5 million in 2012.” Those are eerily similar to Zynga’s numbers immediately preceding their 2011 IPO:

Zynga’s financials are stronger than many of its newly public counterparts, and the company has multiple revenue streams.

In 2010, the company had a $90.6 million profit on sales of $597 million. For the first nine months of 2011, it netted $30.7 million in profit on almost $829 million in sales.5

It will be interesting to follow the $KING stock in the coming days. Will the game maker suffer the same fate as Zynga?

- King Press Release, “King Announces Pricing of Initial Public Offering,” 25 March 2014 ▲

- Ben Popper, The Verge, “‘Candy Crush’ company King falters in stock market debut,” March 26, 2014 ▲

- Via @PrivCo ▲

- Julianne Pepitone, CNNMoney, “Zynga shares close below IPO price,” December 16, 2011 ▲

- Pepitone, “Zynga shares close below IPO price.” ▲