There are so many places to get information on angel investors and venture capitalists. I just published this article on 5 tips to find an angel investor yesterday. Countless websites offer both good and bad information on investors and what they are looking for, how to attract them, what to include in your pitch deck, what you should say and more. There’s even great articles like this about relaxing before your big pitch meeting. If you’re looking for good advice directly from a VC then go straight to the source, Fred Wilson’s blog called avc.com you’ll find great insight there.

There are so many places to get information on angel investors and venture capitalists. I just published this article on 5 tips to find an angel investor yesterday. Countless websites offer both good and bad information on investors and what they are looking for, how to attract them, what to include in your pitch deck, what you should say and more. There’s even great articles like this about relaxing before your big pitch meeting. If you’re looking for good advice directly from a VC then go straight to the source, Fred Wilson’s blog called avc.com you’ll find great insight there.

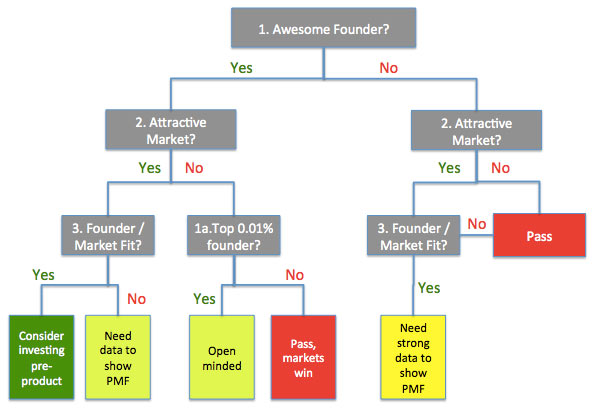

We recently saw this infogrpahic taking a look inside the investor’s mind. Now, Kevin Go co-founder and Partner at NextView ventures has let us take a look inside not his mind, but more importantly his decision making process.

Go talks about this on venturefuzz.com he says that he mapped out his decision making process so that he could look inwards for a better understanding of the deals he chooses.”by charting it out, it helped me to be more explicit about what attributes I’m looking for, and how my opinion about different attributes feeds into an ultimate decision.” he wrote.

Go reveals his first three top level questions that he asks himself on every deal:

1. Is this an awesome founder?

2. Is this a market I want to have an investment in? This incorporates both the total size potential of the opportunity and the attractiveness of the market itself.

3. Is there strong founder market fit? Is this an authentic idea, and does the capability of the founding team map well towards the needs of the market in the early stages of the business?

Now see how that plays out in his decision making tree.

Go offers a thorough explanation and some if this then what scenarios here.