On December 12, Quovo announced that they have closed a $1.4 million in Series A funding led by Long Light Capital LLC. The closing of this round further affirms our thoughts the rise of big-data and advanced analytics. According to CrunchBase, in 2013 there were 335 funding rounds closed by companies in the “Analytics/Big Data” category.1 The growth of such rounds in the last five years is phenomenal: 46 rounds in 2008; 104 rounds in 2009; 193 rounds in 2010; 271 rounds in 2011; 346 rounds in 2012; 335 rounds so far in 2013.2 While there are faster growing segments of the technology industry, this growth should not be overlooked.

On December 12, Quovo announced that they have closed a $1.4 million in Series A funding led by Long Light Capital LLC. The closing of this round further affirms our thoughts the rise of big-data and advanced analytics. According to CrunchBase, in 2013 there were 335 funding rounds closed by companies in the “Analytics/Big Data” category.1 The growth of such rounds in the last five years is phenomenal: 46 rounds in 2008; 104 rounds in 2009; 193 rounds in 2010; 271 rounds in 2011; 346 rounds in 2012; 335 rounds so far in 2013.2 While there are faster growing segments of the technology industry, this growth should not be overlooked.

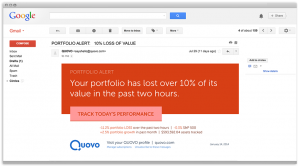

Quovo

Quovo serves as an excellent example of the rise of Big Data.

Quovo serves as an excellent example of the rise of Big Data.

Quovo bills its software as: “Data Science for the Art of Investing.”3 In a nutshell, Quovo offers an advanced investing analytics platform that makes extensive use of Big Data.

While Quovo is not the only software built for investing, the platform offers what seems to be the most complete and robust insights – at least in the consumer sphere. There are a great many powerful investment analytics platforms built specifically for banks, investment firms, and other professional investors. However, Quovo is the first to offer the same detailed level of insights to average, non-professional investors in a clear, understandable way. A statement from Justin Korsant, of Long Light Capital speaks to this fact:

Though a variety of companies offer online investing tools, no one truly marries the investor’s perspective with Big Data capabilities like Quovo; they are building a groundbreaking solution to the most critical problems that all investors face today.4

The level of detail provided by Quovo is remarkable. Without getting into too much detail, as there is an awful lot, Quovo’s core features include:

Automated data aggregation from thousands of financial institutions

Automated data aggregation from thousands of financial institutions- Automated data repair – filling in gaps in data

- A statement crawler that automatically retrieves data directly from brokerage statement PDFs.

- Rich historical data that allows for the analysis of any period, for any component of your portfolio

- Detailed risk analysis from basic volatility and Alpha to stats like Sharpe, Sortino, Information Ratio and Value at Risk.

- The ability to run detailed stress tests and volatility tests

- Timley notifications from tables and charts to on-the-go “heads up” alerts 5

Before Quovo, investors were stuck between simplistic, canned metrics or hyper-complicated technical systems. Quovo’s ultimate goal is to give investors the power of the ‘hyper-complicated technical systems’ in an intuitive, understandable, and scalable way. Quovo’s CEO, Lowell Putnam, summarized the round and company quite succinctly:

Quovo’s platform capabilities, once reserved only for high paying, large institutions and wealth managers, will soon be launched as an end-to-end, cloud-based solution available to a variety of professional investors and individuals.6

- CrunchBase Advanced Search Results: Analytics/Big Data companies funded after December 2012. ▲

- Data for: 2008, 2009, 2010, 2011, 2012, 2013. ▲

- Quovo Website. ▲

- Quovo Secures Series A Funding Press Release ▲

- There are many, many more features outlined on Quovo’s Feature’s Page. ▲

- Quovo Secures Series A Funding Press Release ▲